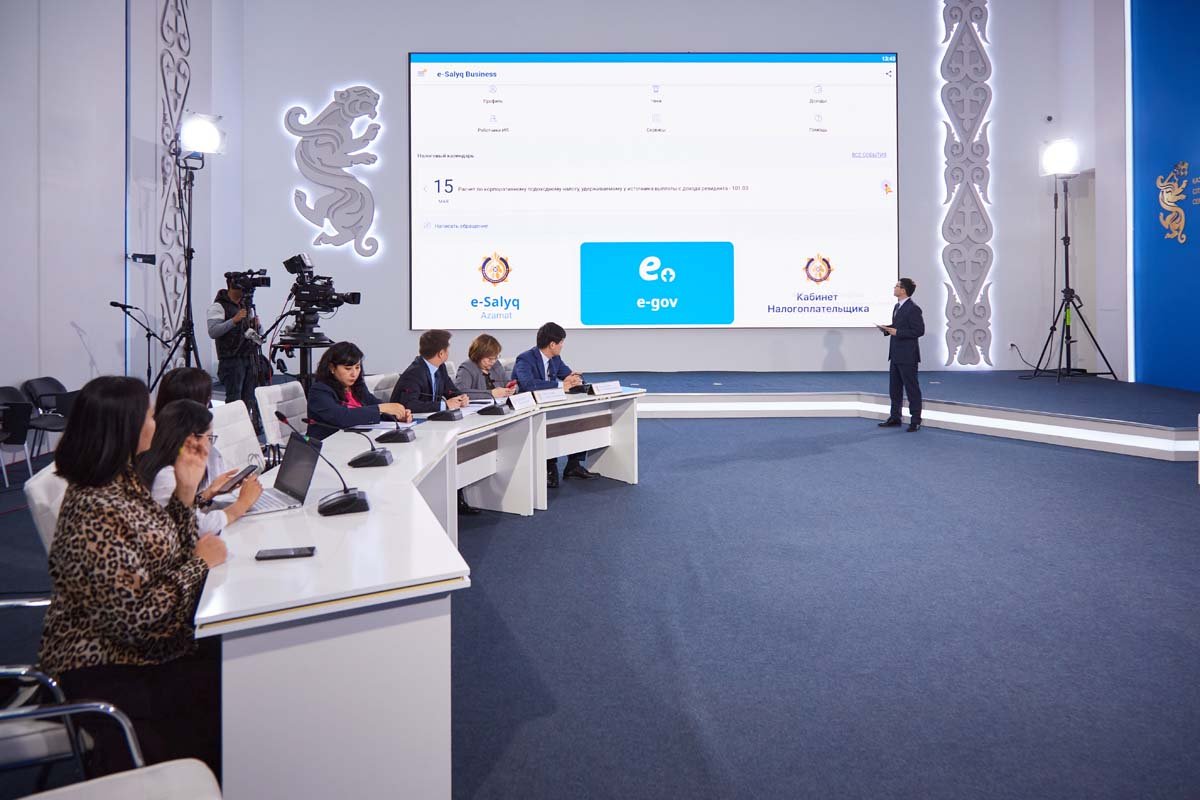

“In the context of each person, his full name, IIN, the amount of wages and benefits are indicated. The dates of admission and dismissal are also indicated here. This year, work is planned in terms of concluding employment contracts, exchanging data on them with the system of the Ministry of Labor. Work continues on the tax reporting module. Preliminary filling of the simplified declaration (form 910.00) is provided. A simplified declaration for 2022 is currently being worked out. The project is being finalized, changes and additions have been made. The report is semi-annual, the first term is in August. The work is carried out according to the established schedule. To ensure the preliminary filling of the declaration, it is necessary to have the data itself, which should be reflected in it,” Panbyaev said.

According to the Deputy Chairman of the State Revenue Committee, one of the main areas of this work is to ensure the completeness of data and their automation, in particular, work on the correct reflection of data from Z-reports.

Central Communications Service

under the President of the Republic of Kazakhstan

+7 (7172) 559344

info@ortcom.kz

info@ortcom.kz